Our Work for your clients is insured by AA+ & A++ Professional Liability Errors & Omissions Insurance and Our Audit Defense Protection

If you would like to become our Referral Partner, please submit your information to go through our qualifying process

we are trusted

Variety of Professionals refer their clients to us

Compassionately Compliant in Tax, Accounting, & Legal

We value our referral partners being involved in tax credit projects and supporting their clients in collecting the necessary information needed to calculate a tax credit.

Recognizing this important role our referral partners play in helping people access their ERC, we want to work collaboratively with them and share a percentage of our fees with them.

Our affiliates get paid within 7 days of us getting paid.

LEARN MORE

Become an affiliate today

We value our referral partners being involved in tax credit projects and supporting their clients in collecting the necessary information needed to calculate a tax credit.

Recognizing this important role our referral partners play in helping people access their ERC, we want to work collaboratively with them and share a percentage of our fees with them.

Our affiliates get paid within 7 days of us getting paid.

LEARN MORE

Become an affiliate today

See commissions for

in SETC Credit

IRSplus's Fee

Your Referral Commission

We have taken the time to build a stronger foundation for our clients. Our real time expansion abilities to meet the requirements of taking on more volume allows us to remain true to our commitment of being the fastest to file.

We have perfected a system that takes just 48 hours from qualifying and calculating to filing the ERC application (once the documents are submitted).

Our clients have real people responding to them when needed. We are fast, efficient, and highly responsive. The ERC Specialist assigned to you ensures accurate qualification, calculations, and quick filing

testimonials

We take no large upfront fees from our clients

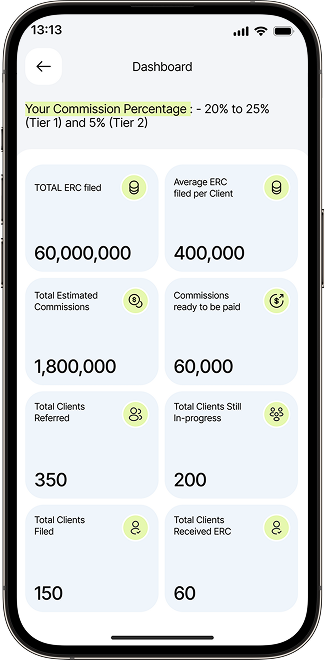

Earn an average of 5% of every ERC refund invoice from your direct referral partners (sub-affiliates)

We like to pay you fast. Once we get paid, and so, you get paid.

The ERC checks are mailed directly to your client by the US Treasury.

Earn up to 20% or more of every ERC refund invoice based on your performance from each business you refer.

Our client fees are negotiable, if you need them to be. Losing a client is bad for business.

Our affiliates always get paid within 7 days of us getting paid.

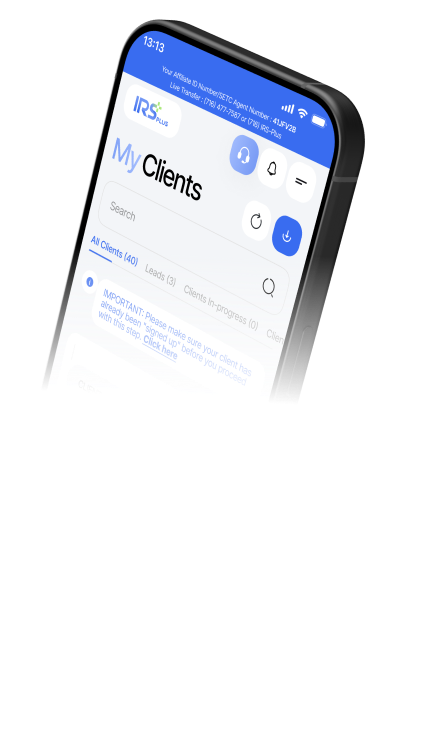

Track your referrals in full transparency, with real time status updates.

Affiliate commission statuses

Client ERC approval statuses

All prefiling client statuses

Client invoice statuses

Your estimated commissions

Affiliate commission statuses

All prefiling client statuses

Client ERC approval statuses

Client invoice statuses

Your estimated commissions

scroll down

We are committed to ensuring your referrals receive the highest quality of service

Top Rated Tax Firm since 2017

Care about the success of our clients

This is the Self Employed Tax Credit (ERC) referral partner opportunity in a nutshell.

What if you could walk into virtually any business, offer them a large chunk of money with no strings attached, and walk out with a sizable commission check having very little expertise?

We know that you are busy working on many different projects for your clients and might not have time to stay on top of all of the paperwork relating to the Employee Retention Credit.

Once you partner with IRSplus, our industry experts will help your clients to identify and pursue tax savings opportunities with no extra work for you to do. You can trust that we will take care of everything, leaving you free to focus on what you do best - building and maintaining relationships with your clients

Gain amazing benefits when you choose us as your trusted ERC filing Partner.

Highest quality of service

Team Expert

Team Expert

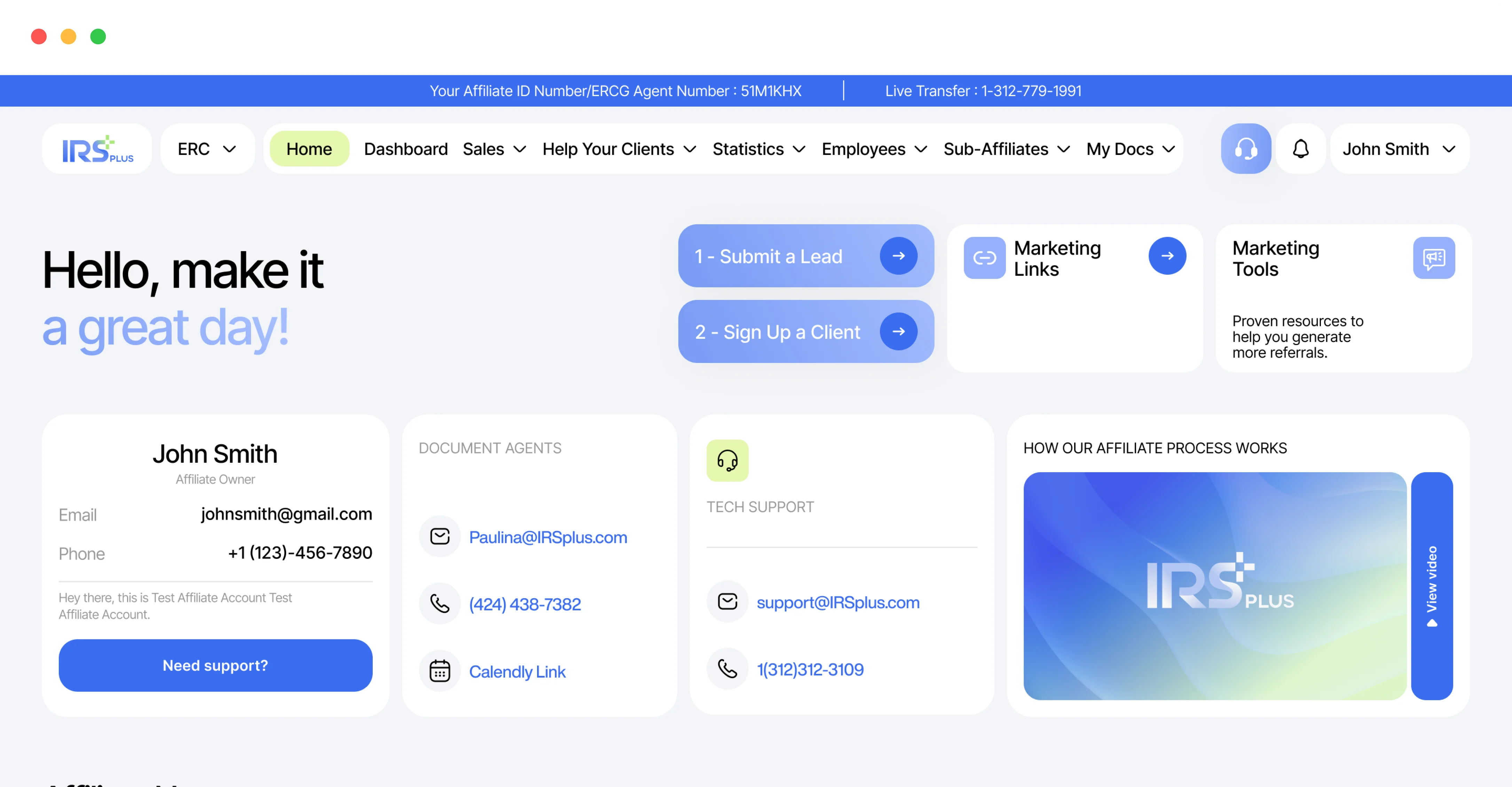

Apply & Get Accepted

Create Your Free Referral Partner Account

Gain access to our Referral Partner web portal and complete the basic training (15 minutes).

01

Share & Introduce to Everyone

Start referring by using your referral links or your team can directly signup clients within the Affiliate Portal.

02

Track your Referred Clients & Get Paid

Our robust platform gives you full visibility of each filing. You can track real-time progress of each status update and payment.

03

Sales and prospecting consulting

Responsive IT and marketing support

Maximum ERC returns

Audit-Protection guarantee

The friendliest filing fees in the industry

More referrals from happy clients

Guest podcast opportunities and shareable social media content

Excellent customer service

Best Customer Service Support

Customized partner dashboard for data tracking

Easy-to-understand calculations

More money to grow their business

Work Insured by Berkshire Hathaway

That of course depends on the amount of effort you are willing to put in. However, we are confident that even by sending out 10 emails a day or speaking to qualified organizations, you could probably get at least 5 to 10 deals like this every month.

This is always a concern for some people when they look at a referral program. The good news is that the ERC opportunity will never become saturated. The reason is that there are approximately 8 million organizations with W2 employees that qualify for the credit, and it is estimated that only around 250,000 of them have filed for their credit so far.

The market is absolutely wide open! There is a two-year window for this opportunity and there is absolutely no concern whatsoever about saturation.

You will receive your commission as soon as IRSplus receives its fee.

In general, it takes about a week from the time you refer a client to IRSplus for the refund to be calculated depending on how soon the client provides their documents, then another 3 to 4 months for the IRS to send the checks to the client.

Once the client receives the checks, they pay IRSplus and IRSplus pays you within a few days.

If you look at this as a longer-term opportunity and are willing to work hard on this for the next one to two years, you could realistically walk away with seven figures.

There are numerous marketing approaches you can adopt to find organizations that you can introduce to IRSplus.

Start with the people you know and the places you frequent. Restaurants, dry cleaners, car washes, retail shops, and basically any service-oriented business in your local area are likely to be eligible.

Don’t forget that churches, private schools, and nonprofit organizations qualify as well.

From there, you can visit local businesses in person, do cold calling, cold emailing, direct mail, various forms of online marketing, or whatever you are most comfortable with. Whichever method you choose, the approach is pretty straightforward.

Start with the question:

“Hey, have you claimed your employee retention credit yet?”

The answer will either be “yes”, “no”, or “what are you talking about?”

If it is one of the latter two, this opens up the conversation to introduce IRSplus as their risk-free solution.

Most accountants are not specialists in this area of tax law.

If you make enough contacts, you will certainly run into businesses and nonprofits that have already claimed their credit, and this means that they either did it through their accountant or another organization like ours.

However, if they are sitting here in 2023 and haven’t filed for their ERC yet, then most likely their accountant either doesn’t know about it, doesn’t know how to file it, or thinks their client doesn’t qualify because they are unfamiliar with the updated rules.

When this happens, you can simply suggest that they get a second opinion from IRSplus without any risk on their part.

We understand that some people may be hesitant to believe that they are eligible for free money with no strings attached.

“it’s too good to be true” Might be the most common one.

But in this case, it actually IS TRUE!

There are very few objections that a person could have to receive free money that has no conditions on how it has to be used and never has to be paid back!

In some cases, their accountant may have wrongly told them that they don’t qualify. Or they might not believe they qualify because their revenue increased in 2020 and 2021 and they do not realize that a revenue loss is not a requirement. 90% of ERC businesses are qualifying due to operational disruptions.

You can reassure them by leaning on IRSplus's credibility. As a company that has been around for almost a decade and helped thousands of clients recover BILLIONS in ERC refunds.

We have worked with some of the biggest names across a wide range of industries, and our track record speaks for itself. Your referrals can trust that they are taking on absolutely no risk by getting a second opinion from one of our ERC specialists. Our team of experts can help them understand their eligibility and ensure that they recover every dollar they are entitled to.

Although anything is possible, this scenario is highly unlikely.

The ERC is a refundable tax credit on payroll taxes that are paid in by US employers every week, so the program never technically “runs out of money”.

However, the rules for claiming the ERC have been changed several times already, and there is a chance that they will be altered again before the program expires.